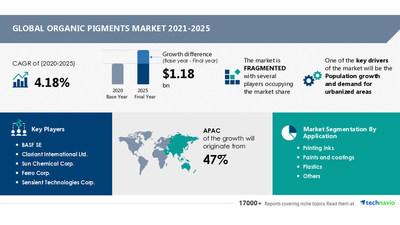

NEW YORK, Dec. 3, 2021 /PRNewswire/ — The organic pigments market size will grow by USD 1.18 bn from 2020 to 2025, as per the latest market analysis report by Technavio. The report also identifies the market growth momentum to accelerate at 4.18% during the forecast period. The report offers an outlook on various factors influencing the current market scenario, latest trends, drivers, and challenges impacting the overall market environment.

For more insights on the CAGR and YOY Growth Analysis, Read our Sample Report

Organic Pigments Market 2020-2025: Vendor Landscape

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Growing industrialization in developing regions has spurred the entry and growth of domestic vendors that often provide strong competition to global vendors because of better customer relationships. Many vendors also provide customized services that enable consumers to choose the exact hue they are looking for. Successful and long-term incumbency can be achieved with optimized production that generates economies of scale through penetration into multi-regional markets.

BASF SE, Clariant International Ltd., Sun Chemical Corp., Ferro Corp., Sensient Technologies Corp., Dainichiseika Color and Chemicals Mfg. Co. Ltd., DCL Corp., DIC Corp., Heubach GmbH, and LANXESS AG are among some of the major market participants. Many companies are offering innovative products to retain their market positions for longer tenures. For instance, BASF SE offers organic pigments which has color-based coating. Similarly, Clariant International Ltd. offers superior quality organic pigments, pigment preparations and dyes used in the automotive industry.

View market outlook before purchasing report to learn more about competitive benchmarking and analysis

Organic Pigments Market 2020-2025: Drivers and Challenges

Population growth and demand for urbanized areas has been instrumental in driving the growth of the market. The migration of individuals from rural to urban areas has led to an improved standard of living and people embracing urban lifestyles. This has further resulted in the development from automotive, construction, and general industrial segments. All these segments are increasingly depending on organic pigments sector for imparting aesthetic appeals. Furthermore, the demand for novel pigments to impose entailing color development for catering to individual tastes has also increased in recent years. For instance, water-based coating systems are being increasingly adopted in the automotive OEM, refinish, rim coatings, accessories, and interiors markets with numerous color-intensive design possibilities. This, in turn, is further expected to drive the organic pigments market growth during the forecast period. In addition, surging regulations on VOC emissions driving the organic pigments market and increasing demand from the coatings sector will further accelerate the market growth during the forecast period.

The high cost of organic pigments might hamper the market growth. Increased acceptance of these products has resulted in competitive pricing with inorganic pigments, which dominate the market, and hybrid pigments, which are slowly penetrating into the pigments market. In addition, the increase in raw material prices is expected to be a hindrance to the global organic pigments market. Added to this, high prices of raw materials are increasing concern for vendors of organic pigments. Fluctuation in the prices of crude oil over the years has had a significant negative impact on the operating costs of the vendors and their profit margins. Furthermore, factors such as volatile raw material prices to negatively impact organic pigments and cumbersome dispersion process will eventually limit the market growth in the long run.

Download Sample Report Now and Gain Further Insights on Crucial Factors Influencing the Market

Organic Pigments Market 2020-2025: Segmentation Analysis

By Application, the market is segmented into

Printing Inks application held the organic pigments market share in 2020. The segment will further dominate the market during the forecast period due to their increased preference of organic pigments over inorganic pigments as they are able to impart brilliance and have high tinctorial strength. Changes in consumer preferences, coupled with the growing importance of packaging in branding and advertising, have increased the use of organic pigments in the packaging sector, therefore, driving the growth of organic pigments in printing inks.

By Type, the market is classified into

Azo pigments led over 52% of the organic pigments market share in 2020. The segment is likely to retain its position as the largest revenue-generating type segment during the forecast period. These pigments are colorless earth and clay materials, which, when treated using azo compounds, impart colors. The pigment carrier is an important aspect that affects the light fastness of azo pigments.

In terms of Geography, the market is segmented by

APAC was the largest revenue-generating regional segment of the organic pigments market in 2020. The region is expected to record the fastest market growth in the upcoming years. The increase in focus on development, rapid industrialization, and the flourishing automotive industry, especially in China and India, are anticipated to drive the demand for paints and coatings. This, in turn, translates to the high demand for organic pigments in the region. End-user industries such as automotive and construction will drive the growth of the organic pigments market in APAC during the forecast period. Countries like China, India, and Japan contribute a major market share in the global automotive industry. In addition, stringent government norms to reduce products with high petrochemical or VOC content is a growth driver for the organic pigments market.

Download Sample Now for Additional Segments and Their Market Share Contribution

Organic Pigments Market 2020-2025: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. The organic pigments market report covers the following areas:

Organic Pigments Market Size

Organic Pigments Market Trends

Organic Pigments Market Industry Analysis

For customizing this Report to Meet your Business Requirements, Talk to our Analysts.

Organic Pigments Market 2021-2025: Key Highlights

CAGR of the market during the forecast period 2021-2025

Detailed information on factors that will assist organic pigments market growth during the next five years

Estimation of the organic pigments market size and its contribution to the parent market

Predictions on upcoming trends and changes in consumer behavior

The growth of the organic pigments market

Analysis of the market's competitive landscape and detailed information on vendors

Comprehensive details of factors that will challenge the growth of organic pigments market, vendors

Subscribe to our "Lite Plan" billed annually at USD 3000 that enables you to download 3 reports a year and view 3 reports every month.

Related Reports

Specialty Chemicals Market by End-user and Geography – Forecast and Analysis 2021-2025

Waterborne Coatings Market by Product, End-user, and Geography – Forecast and Analysis 2021-2025

Coatings Raw Materials Market by Type and Geography – Forecast and Analysis 2021-2025

Organic Pigments Market Scope

Report Coverage

Details

Page number

120

Base year

2020

Forecast period

2021-2025

Growth momentum & CAGR

Accelerate at a CAGR of 4.18%

Market growth 2021-2025

USD 1.18 billion

Market structure

Fragmented

YoY growth (%)

2.96

Regional analysis

APAC, Europe, North America, South America, and MEA

Performing market contribution

APAC at 47%

Key consumer countries

US, China, Germany, Japan, and India

Competitive landscape

Leading companies, competitive strategies, consumer engagement scope

Companies profiled

BASF SE, Clariant International Ltd., Sun Chemical Corp., Ferro Corp., Sensient Technologies Corp., Dainichiseika Color and Chemicals Mfg. Co. Ltd., DCL Corp., DIC Corp., , Heubach GmbH, and LANXESS AG

Market Dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and future consumer dynamics, market condition analysis for the forecast period

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Key Topics Covered

Executive Summary

Market Landscape

Market Sizing

Five Forces Analysis

Market Segmentation by Application

Market Segmentation by Type

Customer landscape

Geographic Landscape

Vendor Landscape

Vendor Analysis

Appendix

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

Newsroom: https://newsroom.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/organic-pigments-market-to-grow-by-4-18-cagr–47-of-growth-to-originate-from-apac–17-000-technavio-research-reports-301436540.html

SOURCE Technavio

The Oracle of Omaha knows how to beat inflation. So ride his coattails.

The market is nervous about omicron. Cramer says it's time to pounce.

Shares of Alibaba (NYSE: BABA) fell another 22.7% in November, according to data from S&P Global Market Intelligence. The company not only reported underwhelming earnings, but also sold off after China's Cyberspace Administrator asked another company to delist from U.S. exchanges, causing new worries for Chinese stocks like Alibaba that are also listed in the U.S. In the quarter ended in September, Alibaba grew revenue 29% and reported earnings per share of $1.74 per American depositary share (ADS).

The crypto's price dropped more than 20% at one point Saturday. The slide is tied to the Fed's signal that the end is coming soon for its pandemic-era bond buying.

A downturn in global stocks appears to be spilling over into the nascent crypto market. Here's what experts say is happening.

On a day when the Nasdaq index is down more than 2%, it shouldn't be surprising that aggressive growth names in the EV sector are leading the way. In addition to market sentiment going against high-growth, speculative companies such as these, Chinese stocks in general are in the crosshairs today. Despite the recent macro factors impacting the share prices of Nio, XPeng, and Li Auto, each company reported strong growth in its latest delivery update.

Shares of DraftKings (NASDAQ: DKNG) fell 9.4% on Friday after noted short-seller Jim Chanos said he was betting against the sports betting company. "If you quadrupled DraftKings' revenue and gross profit … and take their marketing spending, which is currently over 100% of revenue, to 10% of revenue, which is their target, and you keep overhead at today's level … DraftKings would still be losing $200 million a quarter," Chanos said. It should be noted, however, that DraftKings CEO Jason Robins vehemently disagrees with that view.

DocuSign Inc. emerged as a hot pandemic stock play last year as it benefited from the need for digital contract tools, but the company lost more than 40% of its valuation Friday after suggesting the pandemic-induced demand boom is waning.

AT&T (NYSE: T) was once considered a stable blue-chip stock for income investors. AT&T's decline can be traced back to three big mistakes. First, it bought DirecTV for $49 billion in 2015 in an ill-fated attempt to expand its pay-TV business.

In 2019, PepsiCo sued some Indian farmers based in the western state of Gujarat for cultivating the FC5 potato variety, which has a lower moisture content required to make snacks such as potato chips. Withdrawing the lawsuits the same year, the New York-based company said it wanted to settle the issue amicably.

The leading cryptocurrency is currently trading around $47,960.

Shares of Adobe Inc. are sinking Friday and on track for their worst performance in more than 20 months, after DocuSign Inc. delivered what some saw as a the latest sign of a cool-down in demand for work-from-home software.

(Bloomberg) — A brutal 2021 selloff for Chinese stocks trading in the U.S. has now erased more than $1 trillion in value since February and shows no signs of easing as regulators on both sides of the globe continue to put pressure on the firms.Most Read from BloombergThe Hot New Trend For Hedge Funds Is—Finally—Female Founders‘Ghost Signs’ Haunt London’s Reviving NeighborhoodsAutomating the War on Noise PollutionThe Nasdaq Golden Dragon China Index — which tracks China-exposed firms listed in

The famed investor is bearish on stocks — except for this 1 key sector.

Florida-based company Trans Caspian Resources has come up with a solution that could link Turkmenistan’s huge gas reserves to Azerbaijan, and further on to Europe

In this environment, there's plenty of excitement around growth stocks, but smart investors could do themselves a favor by giving some attention to top value names, especially those that are trading at discounted levels. With that in mind, we asked a panel of Motley Fool contributors to identify three stocks that are currently bargain-priced and positioned to deliver big gains. Here's why they think that Zynga (NASDAQ: ZNGA), The Walt Disney Company (NYSE: DIS), and Cardinal Health (NYSE: CAH) offer incredible value and should be snatched up before the year is over.

How much money people have put away for retirement naturally varies by age group. See how your savings stack up.

The Buccaneers’ star was caught using a Covid vaccination card with false information on it. But the investigation was a warning sign for employers everywhere: verifying records can be extremely challenging.

Donald Trump's new social media company and its special purpose acquisition company partner say the partner has agreements for $1 billion in capital from institutional investors.

Merck & Co., Inc. ( NYSE:MRK ) has announced that it will be increasing its dividend on the 7th of January to US$0.69…

Organic Pigments Market to Grow by 4.18% CAGR | 47% of Growth To Originate from APAC | 17,000+ Technavio Research Reports – Yahoo Finance