Lorado/E+ via Getty Images

Lorado/E+ via Getty Images

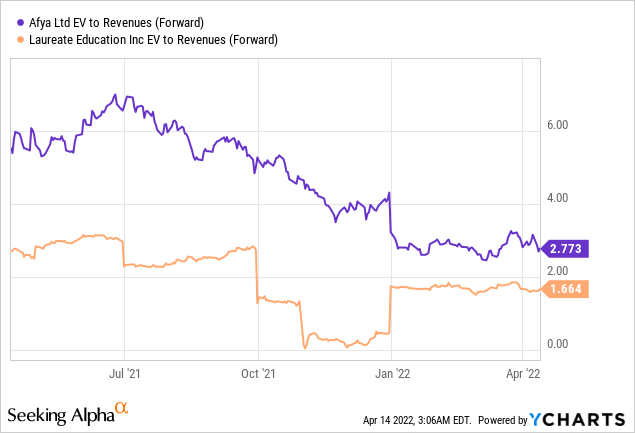

Afya’s (NASDAQ:AFYA) commitment to building out a complete ecosystem for physicians through new initiatives such as its digital service strategy deserves credit. Coupled with the company’s undergraduate medical school leadership, Afya is competitively positioned to benefit from secular trends in Brazil’s higher education segment over the long run. That said, near-term guidance indicates margin pressure ahead amid post-M&A integration efforts and investments in the B2B portfolio within digital services. Plus, a post-COVID recovery in the continuing education segment isn’t a given, and thus, any slowdown in the student base could further weigh on the margin outlook. While the valuation multiple has compressed YTD, it continues to trade richly relative to peers, and thus, I think there could still be downside potential from here.

Afya’s Q4 2021 results offered investors little cheer, as key metrics (adjusted for one-offs) disappointed across the board. Headline net revenue growth of 44% YoY to R$498m may have seemed positive, but much of the YoY delta was helped by recent M&A as well as the maturation of medical school seats. If we exclude acquisitions, revenue was much lower at ~R$377m or +9% YoY. Trends on the cost side were also masked by non-recurring items (see table below) amounting to ~R$39m in non-recurring expenses, without which EBITDA would have been closer to R$156m (vs. the disclosed adj. EBITDA of R$195m). Still, the adj margins were down ~6%pts YoY to 39%, while organic adj. EBITDA also moved ~3% YoY lower amid the consolidation of less profitable digital acquisitions and weakness in the continuing education segment. Finally, a 53% YoY increase in organic capex drove operating cash flow into negative territory, with net debt (including M&A payables) up to R$2.1bn as of quarter-end.

R$m

Adj EBITDA

195

(-) Integration Costs

6

(-) Other M&A expenses

2

(-) Expansion Costs

4

(-) Restructuring Expenses

6

(-) Mandatory Tuition Fee Discounts

7

(-) Stock Options

9

(-) Interest on Late Payments

5

= EBITDA

156

Source: Afya Q4 2021 Earnings Report

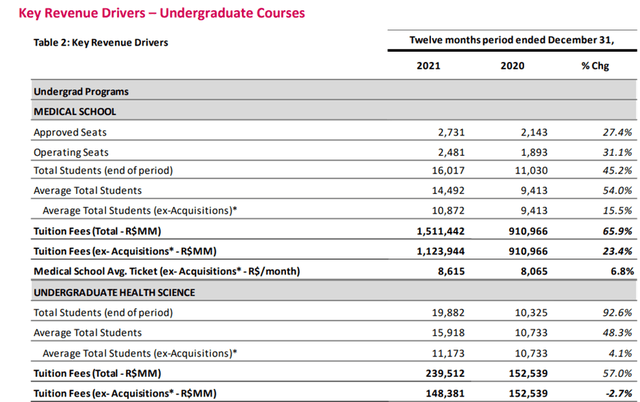

On a more positive note, Afya did end the quarter with 2.7k medical school seats (+27% YoY) and 16k medical students (+45% YoY), helped by the consolidation of Unigranrio in the prior quarter. The health undergrad division grew at an accelerated ~93% YoY to 20k students in Q4 2021 (including M&A), although on an organic basis, growth was at a more modest ~4%. That said, the ex-M&A tuition increases for medical undergrad (+7% YoY) and health sciences (-3% YoY) are running below inflation, indicating Afya’s limited pricing power at this juncture.

Afya Q4 2021 Release

Afya Q4 2021 Release

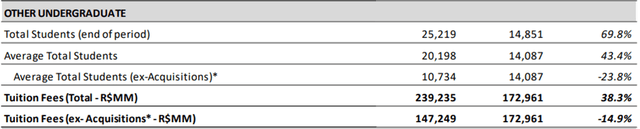

Outside of the medical business, Afya is suffering serious headwinds – continuing education, in particular, has been the major drag at -24% YoY, leading to a ~15% YoY decline in tuition. The key issue is the student base, which fell ~24% YoY, as intakes during 2021 were impacted by COVID-19. Afya’s mostly practical course offerings, which favor in-person instruction, compound its COVID-driven woes. In addition, digital services have also weighed on the financials – the unit delivered ~19% YoY growth at R$42m but excluding M&A, organic digital services revenue would have been down ~4% YoY. While the 2022 guidance numbers show a return to growth, margins will still be impacted by a full year of headwinds from the integration of its major 2021 acquisitions (Unigranrio and UniFIPMOC) as well as initial spend on B2B digital launches.

Afya Q4 2021 Release

Afya Q4 2021 Release

While the near-term headwinds are unavoidable, the good news is that Afya continues to expand and strengthen its leadership position (organically and inorganically). Afya’s pricing power should improve over time and help the organic growth path, along with the potential ~1.2k additional medical seats. On the margin side, post-acquisition efficiency gains are key, particularly with the company maintaining its consolidation path (albeit at a more gradual pace). This year, Afya has already made strides forward in its expansion efforts – for instance, the addition of 28 seats at UniSL in the Ji-Parana city. More importantly for the financial outlook, the deal structure reflects its discipline, with seats tied to an earn-out of ~R$0.8m/seat (equivalent to a R$22m total payment). The R$0.8m/seat price also compares favorably with recent acquisitions such as UniFIPMoc and FCMPB, which came at R$1.9- 2.1m and R$2.2m/seat, respectively. Assuming Afya maintains this discipline in acquiring its 200 seats/year target, the M&A pipeline should yield an accretive outcome.

I think Afya deserves credit for the ecosystem it is building for physicians in Brazil – having already established a leadership role in the undergraduate medical school segment, Afya is rolling out a digital service strategy to better serve post-COVID demand trends. That said, the near-term guidance offers little to be optimistic about, as margins will remain pressured by the mix shift toward digital services and could lead to a 0-2%pt YoY headwind as the continuing education student base also struggles to recover to pre-pandemic levels. The stock trades much lower following the valuation de-rating in recent months, but I don’t see a compelling reason to own it here given the relative premium to closest peer Laureate Education (LAUR).

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.