WAKEFIELD – In our latest Ecotextile Talks podcast, our cotton...

Continue reading...organic

Organic Seeds Market Worth $9.79 Billion by 2028 – Market Size, Share, Forecasts, & Trends Analysis Report with COVID-19 Impact by Introspective Market Research – Digital Journal

Hi, what are you looking for?ByPublishedMarket Overview: The Organic Seeds...

Continue reading...5 things: Sodexo North America sees 22.6% organic growth in Q3 – Food Management

Food Management is part of the Informa Connect Division of...

Continue reading...Indigo Shire Council creates organic, biodynamic farm register – FreshPlaza.com

Patrick Mickan has been working the land in Beechworth for...

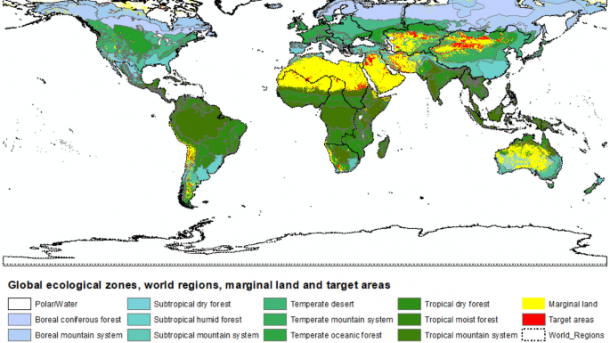

Continue reading...A generalizable framework for spatially explicit exploration of soil organic carbon sequestration on global marginal land | Scientific Reports – Nature.com

Thank you for visiting nature.com. You are using a browser...

Continue reading...2022 seeing better organic banana supplies over 2021 – FreshPlaza.com

Organic banana supplies have improved over this time last year.Along...

Continue reading...Cotton Bikini Panties Canada – Frank And Oak Women's Organic Underwear Collection Launch – EIN News

There were 929 press releases posted in the last 24...

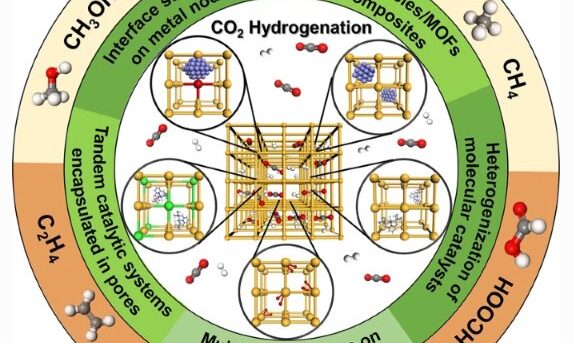

Continue reading...Review of technologies that boost potential for carbon dioxide conversion to useful products – Phys.org

Click here to sign in with or Forget Password? Learn...

Continue reading...Organic Dried Fruit Market – Designer Women – Designer Women

Market Reports offers a latest published report on “Global Organic Dried...

Continue reading...